Description

Editable Excel Format: Customize and tailor your salary slip to your specific needs and preferences directly within Excel.

User-Friendly Interface: Intuitive design makes it easy to navigate and edit the template, even for beginners.

Comprehensive Details: Include all necessary information such as salary breakdown, deductions, allowances, and more.

Professional Appearance: Present your financial information neatly and professionally with our sleek and polished template.

Instant Download: Access the template immediately after purchase and start using it right away.

Compatibility: Works seamlessly with Microsoft Excel, ensuring compatibility across various devices and platforms.

Time-Saving: Eliminate the need for manual salary slip creation with our pre-designed template, saving you valuable time.

Customizable Layout: Arrange and organize your salary slip layout to suit your preferences and requirements.

Secure Data: Keep your financial information confidential and secure by managing it directly within your own Excel file.

Unlimited Usage: Use the template repeatedly for all your salary slip needs, without any limitations or restrictions.

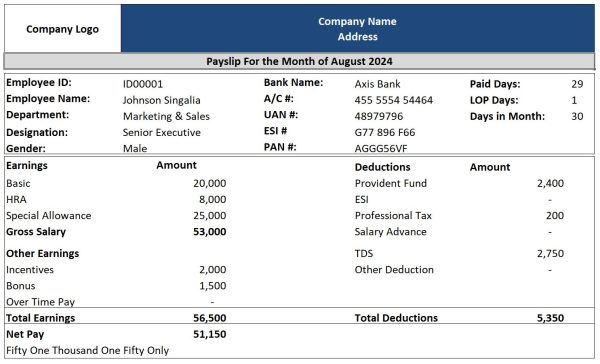

Steps to Edit,

- You first need to set up general information about the company. For example, we should include the company name, address, phone number, and logo. After that, you can have any other information regarding the company.

- Next, you need to specify which month your salary is paid for.

- Next, you have to include all the information related to employees. Employee information should consist of the following items. (Employee name, ID, designation, department, gender, date of joining, and location.)

- Once the employee information is provided, we need to show the employee’s bank account number, bank name, UAN number, ESI number, and PAN number.

- Next, you need to show the period of paid days, LOP days, and days in a month.

- Once employer and employee information is inserted, we need to insert salary details per the break-up.

- We need to include other earnings like incentives, bonuses, overtime, etc.

- Once the earning part is decided, we need to mention the deductions under various heads per the government’s rules.

- Next, we need to arrive at the net pay amount. To calculate this, apply the formula: Total Earnings – Total Deductions.